Minerva’s View

.

Climate Change: What Does the Science Actually Say, And What Should We Be Doing Now?

According to the United Nations Intergovernmental Panel on Climate Change (IPCC) we still have a narrow window to keep global warming from going above the 1.5°C target. Concerning, but not alarming. However, according to Global Warming in the Pipeline, published by a high powered team of scientists that includes James Hansen, that goal is “dead as a doornail.”

Photo: People on a flooded Brooklyn street, Sept 29, 2023. Yuki Iwamura, The Washington Post

Strategies to Popularize Climate Solutions: Gaining Traction with Multi-Solving

Without public demand and political pressure for new climate solutions, “business as usual” will likely prevail until it’s too late to avert climate change’s worst impacts. How can we shift the prevailing conversation?

Hitting the Snooze Button

The new UN IPCC report calls for urgent action. Lulled by the momentum of daily life and its distractions, we are sleeping through the alarm.

Dangerous Climate Tipping Points

Around the world there are alarming reports of catastrophic floods; extreme drought and heat conditions; unprecedentedly ferocious wildfires; and reduced harvests.

Black Lives Matter and Climate Change

What if we could welcome conversations with one another that allow us to express and hear one another’s pain and to experience our common humanity? What if we treated each person as precious and worthy of respect and equality?

Regenerative Urban Design and Climate Consequences

The recent storms and floods in the Midwest, fires in the west, and the prospect of Sea Level Rise in the Bay Area present opportunities to plan for and invest in rebuilding that is regenerative and resilient.

Climate Risks and Indigenous Communities: Impacts and Solutions

As we begin to understand the devastating impacts of the Australian “mega-fires” on the country’s economy ($100 billion), landscape (more than 25.6 million acres torched), and biodiversity (an estimated 1 billion animals killed), very little has been written about the fires….

What’s Next After the UN Congress of Parties in Madrid?

The house is on fire and we stand idly by, wringing our hands.

UN Congress of Parties (COP) in Madrid ended without sufficient new commitments to meet the target of keeping warming to below 1.5 °C or even 2.0 °C. …

In This Together

When I was 19 and a student in France, I lived with a wonderful family as part-time nanny for their 5 children. One time, when the parents went off to Paris for a few days and left me in charge of their brood, Patrick, the 3 year-old, came down with a fever and I had to call in the doctor who lived near the old church.

Transforming Climate Anxiety into Action

You’ve probably noticed that the weather is changing – hotter sooner, more storms, higher winds, unprecedented firestorms, floods, and droughts. We humans are mammals first. Even for those of us who live mostly in-doors, we sense when there’s a deviation from normal and it makes us uneasy.

Action in the Face of Climate Catastrophe

Amongst all the scary news that CO2 levels have surpassed 415 ppm, a million species are facing extinction and oceans are being choked by plastic and toxic pollution, there are rays of hope. Individuals, governments and corporations are stepping up to take bolder action.

Joseph Kott: Humanitarian and Sustainable Transportation Leader

The Minerva Ventures team regrets to share this sorrowful news. We worked with Joe for many years and appreciated his kind heart, deep knowledge and his passion for the role of transportation in making communities vibrant, equitable and sustainable. The Transportation Choices for Sustainable Communities Research and Policy Institute will strive to carry on his work and honor his memory.

COP 24: Finding Consensus on the Brink of Failure

The UN Congress of Parties (COP 24) climate meetings were held in Katowice, Poland from 3-12, December 2018. The conference was convened to finalize the rules for countries to monitor and to cut emissions ahead of 2020. The COP 24 conference also agreed on the need for transparency around richer nation’s assistance to poorer countries.

Message to Leaders on Election Day 2018

Dr. James Hansen testified to Congress in 1988, warning that climate change was happening and that policy makers needed to take urgent action. 41 years later his dire predictions are here.

Global Climate Action Summit 2018

The Global Climate Action Summit in San Francisco from September 12-14 was a thrilling call to action. Mae Jamison, astronaut, spoke of the fragile beauty of the earth, isolated in space.

Climate Adaptation in South Africa

Recently, Minerva’s Karl Van Orsdol, completed a climate vulnerability assessment project in the town of Kuboes, South Africa. Kuboes (Population 1,000) is an isolated indigenous community of Nama Peoples located in the Northern Cape province which, like Cape Town some 600 km to the south, has been reeling under the affects of a major drought.

Report from South Africa

Update on Karl’s adventures in South Africa 1) to build a rain water collection system at a school which had no permanent water source, and 2) to study the way that rural communities like Kuboes are adapting to the changing climate in South Africa.

Pleasant Surprise in Osaka

I never expected to see the picture of 17 UN Sustainable Development Goals all over Osaka, Japan this spring…Please read on to find out what is happening over there…

Hope & Despair

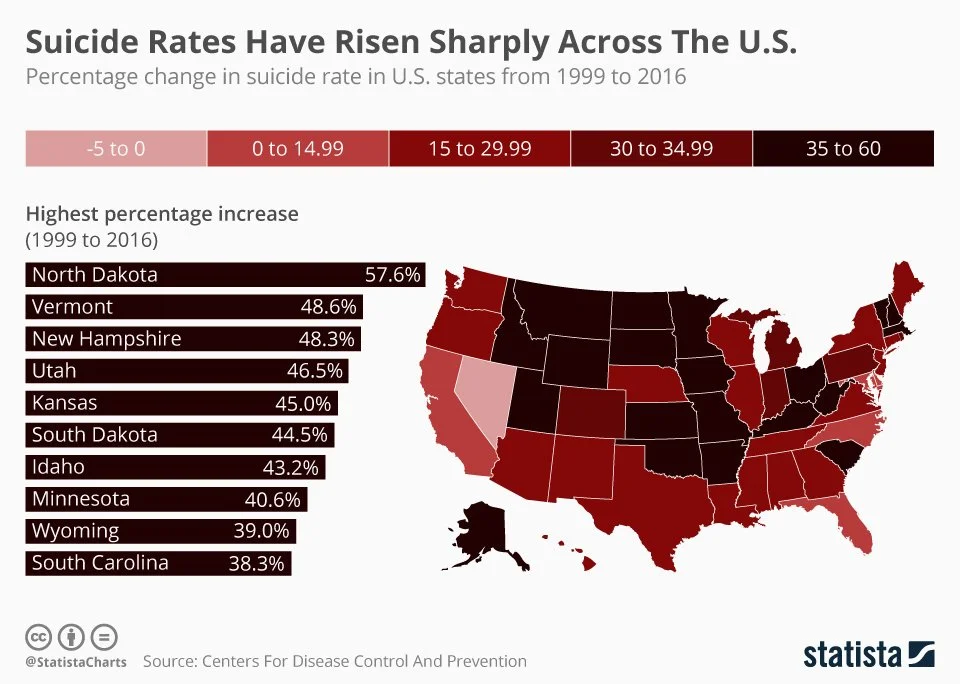

Suicide is on the rise throughout the U.S. Can we design communities to reduce isolation and increase connectedness and resilience?

Mission: Restore the Earth

Humans must transform how we related to the earth and to one another so that we repair and restore the life support systems of the planet. We are but a thread in the web of life and simply tweaking our behavior to be "less bad" or to gradually reduce carbon emissions will not suffice. We need to take bold actions for restoration, based on an understanding of complex systems. We need to cherish and nurture the Earth systems and resources and not exploit them.